Top ways to cut your expenses and increase your savings

Published by MFAA

Is the key to saving a home deposit as simple as giving up ‘smashed avo’? Well not quite, but spending less does make a difference.

On top of a budget, a savings plan, and strategies such as a high-interest savings account, an effective way to save is to reduce or eliminate expenses.

Start by understanding your spending

It can be easy to lose track of how you’re spending money, especially if you use cashless payments, credit cards and buy now pay later options.

Many online banking systems include tools to categorise debits and make a budget – so take advantage of them. Or download an app that helps you track your personal expenses on the go, like ASIC’s TrackMySPEND.

Find savings in the essentials

Some costs can’t be avoided – but many everyday expenses can be reduced – so look for opportunities to save in all areas of your spending, not just in your indulgences. For example, you could:

- Move in with your parents/relatives, or move into a cheaper rental or share house (short-term discomfort can pay off in the longer term).

- Implement daily or weekly tactics like meal planning, making grocery lists and buying in bulk to save money on food. Set aside a budget for eating out/take-away and stick to it.

- Shop around to reduce your regular bills – you may get better value if you switch, or tell current providers you intend to switch. Seek discounts for taking out multiple policies with one insurer.

- Use the car less – take public transport; carpool with colleagues; or try walking or riding. You’ll be amazed at how quickly it all adds up to savings.

- Make sure you’re paying off debts or credit cards completely each month or as much as possible, to avoid the added expense of paying additional (compounding) interest.

Reduce common overspending

It can be important to indulge occasionally, but if you spend excessively on things like a daily coffee, buying clothes, going out or expensive hobbies, it may be unrealistic to cut the expense entirely. Instead, set a weekly or monthly luxury-items budget and reduce that limit over time.

Or, if you do come across an item you feel you ‘must have’, don’t buy it straight away. Instead plan to buy it in a day or two’s time. In that time, you’ll be able to consider that purchase more rationally and may come to realise you could do without it after all.

A Galaxy survey of more than 1000 Australians showed that 73% have a problem with overspending. In particular, people tend to go overboard each time Christmas rolls around.

To reduce gift expenses, be like Santa and make a list (and a budget). Buy only planned items within your allocated budget – then stop. Ask your family and friends for support, arrange with them to put a cap of gift values, it's easier to stick to a budget if everyone has the same limit.

Another common way Aussies overspend is on holidays. CommBank research has shown that a third of holidaymakers spent more on their trip than planned. Do your research and set a daily budget. If you are travelling overseas, consider setting up a separate bank account or a foreign currency card, instead of relying on your credit card. That way you can’t spend more than you’ve budgeted for (unless it’s an emergency).

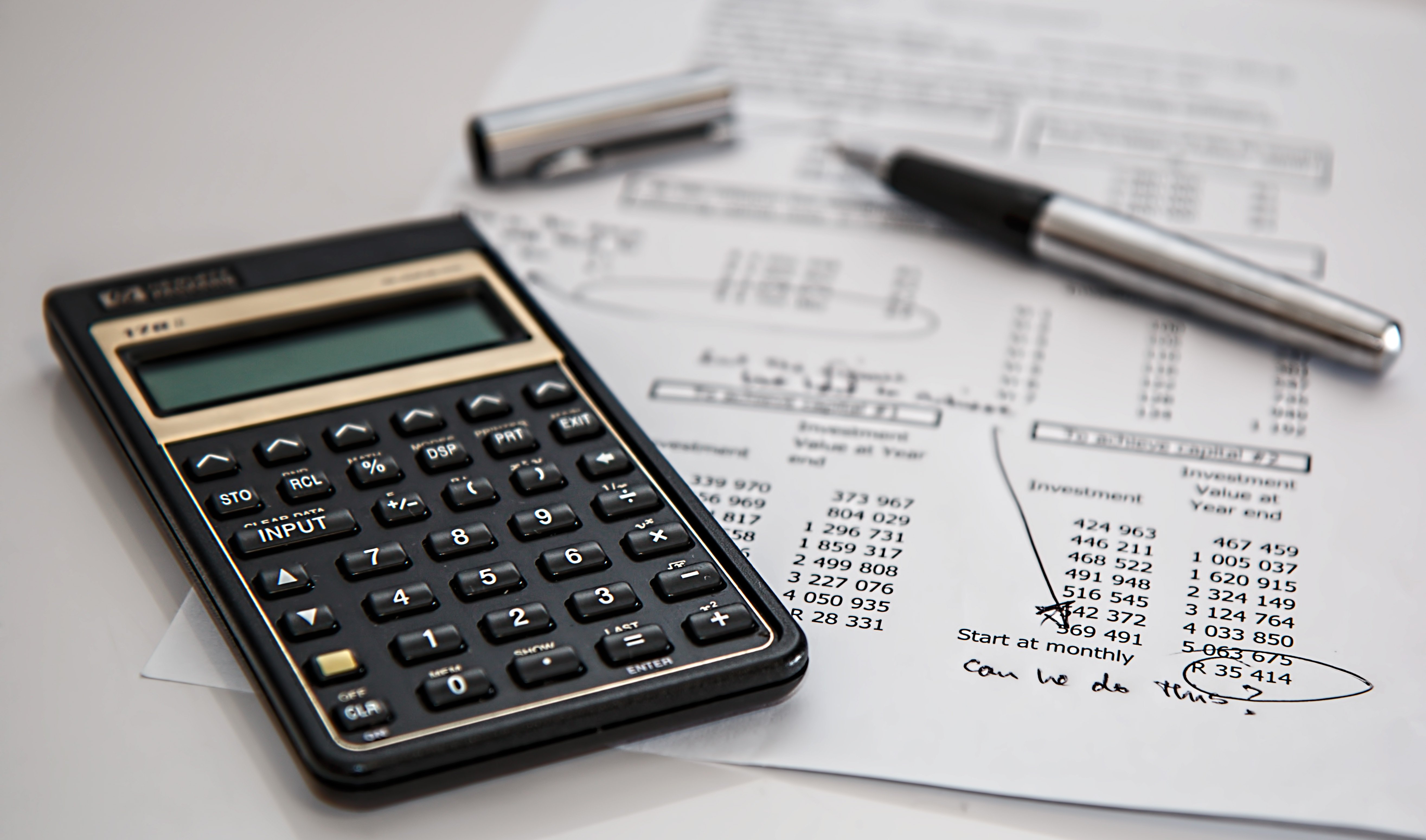

Cancel those unused subscriptions

Another opportunity to reduce your spending is to review those ongoing but forgotten, monthly fees you may be charged for plans and subscriptions. For instance, are you paying for gym membership that you don’t use, or Netflix that you don’t watch? Or are you even paying too much on your phone or internet plans?

A good way to get a snap shot of these expenses is to review your credit card and bank statements. Although $15 a week for the gym or Netflix doesn’t sound like a lot, it adds up to $780 per year.

Instead, if you can cut these unused plan or subscription expenses, have the amount saved each week automatically transferred in to your savings account.

Overall remember, every wasted dollar is money you could be spending on your own home.